You Stay in Control

Every agent has clear checkpoints. You decide what gets reviewed, what auto-approves, and where the boundaries sit.

AI agents that take over the manual, repetitive finance work nobody wants to do — routing, processing, and posting across your inbox and systems automatically.

Trusted by innovative finance teams

Most tools assist. Numra executes.

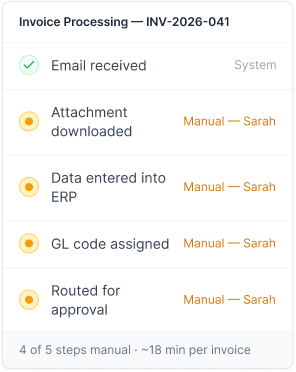

Your systems handle structured data, but the work between them lands on your team. Most tools suggest and surface. Someone still has to push it through.

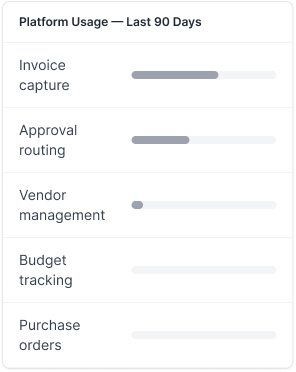

Most platforms ship 200 features. You use 15. Even those don't quite match your process, so your team adapts to the tool.

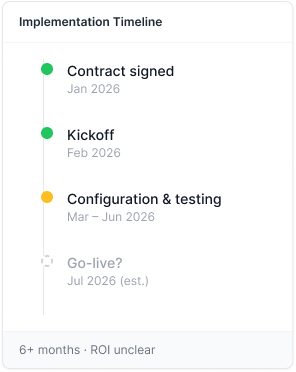

Large licence fee. Months of setup. You hope it pays off. By the time you know, you're already locked in.

Numra runs the workflow across your systems. Your team reviews only where it matters.

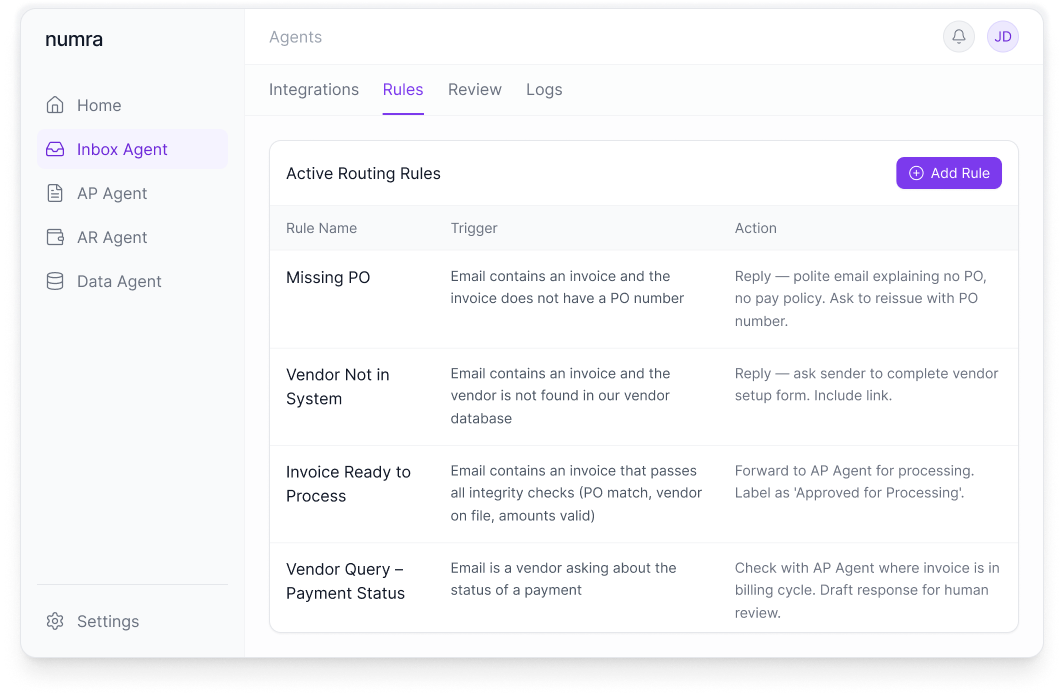

| Rule | Action |

|---|---|

| Missing PO | Reply explaining no PO, no pay policy. Ask to reissue. |

| Vendor Not in System | Reply with vendor setup form link. |

| Invoice Ready | Label as Invoice. Proceed to processing. |

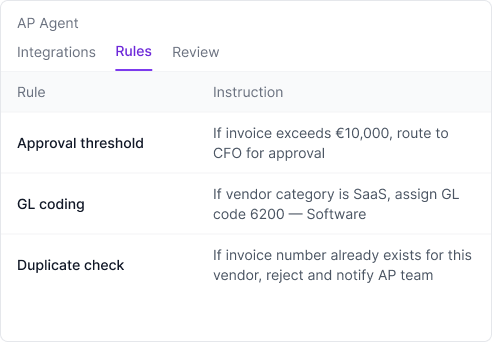

Your rules, logic, and edge cases captured and applied every time.

We calculate time saved and cost per transaction upfront. If it doesn't stack up, we don't proceed.

"A must have tool for modern finance teams. Autonomous accounting is here now, and Numra is leading the way."

Numra agents read, reason, and act across your systems — with your team in control where it matters.

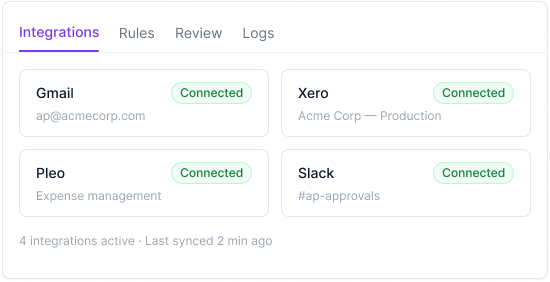

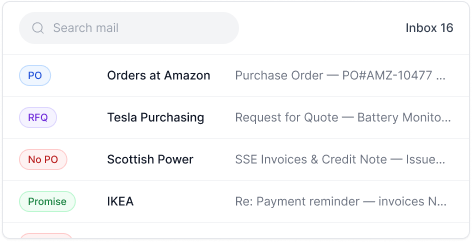

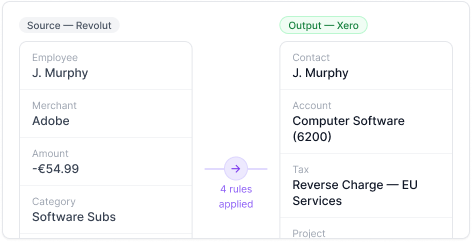

Numra plugs into your inbox, ERP, expense tools, bank feeds, and CRM. Agents read emails, open attachments, extract data, and post back to the right place. No uploads. No copy-paste. No brittle file transfers.

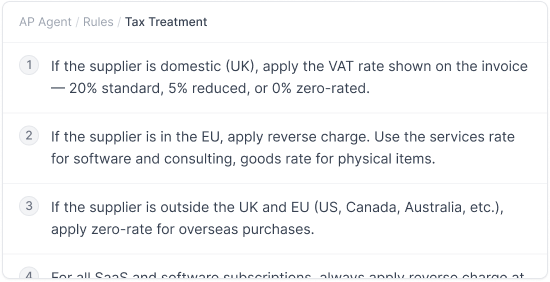

Every finance process has logic: coding rules, approval thresholds, exception handling. Numra captures that logic in plain English and executes it exactly.

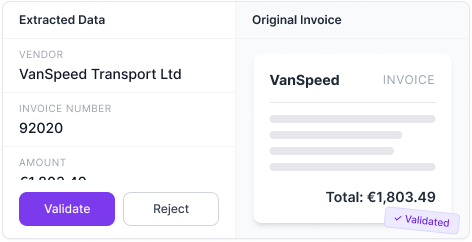

Invoices vary. Contracts vary. Transactions need context. Agents reason through them the way your team would.

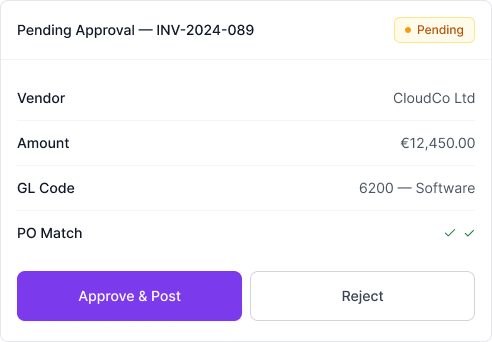

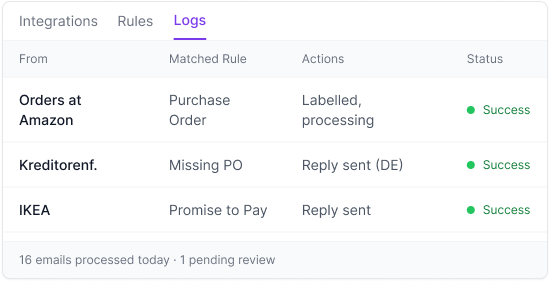

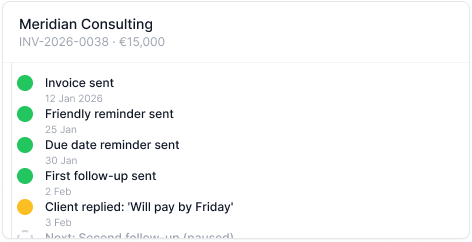

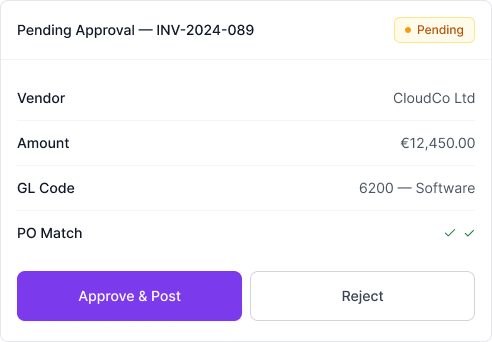

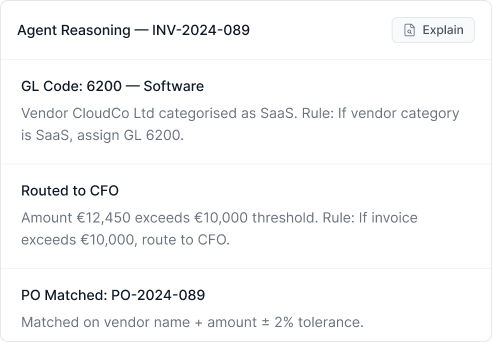

Before anything is posted or sent, your team can review what happened and why. Every decision includes full reasoning — source, rule applied, conclusion reached. If something looks wrong, correct it and update the rule.

If it repeats, it can be automated.

Agents read incoming requests, detect intent, draft replies, and trigger the right workflow across AP, AR, and operations.

Capture invoices, apply coding rules, match to POs, route approvals, and manage vendor setup — aligned to your existing process.

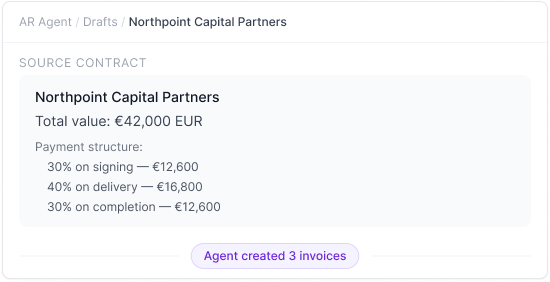

Generate invoices from contracts, follow up on balances, apply cash, and keep billing moving without manual chasing.

Move, clean, and reshape data between CRM, ERP, and spend tools so it posts correctly every time.

"Numra is effective, easy to use and user-friendly. The team behind Numra have been fantastic to work with."

Most teams underestimate what an agent can handle. Walk us through your process. We'll show what's possible, the expected time saved, and the projected payback.

Get Your Free Workflow AssessmentFree call · Clear answer · No commitment

New tools shouldn't take a year to implement.

"Invoices were landing and we had to hand check each one to check the entity and then forward it to the appropriate inbox. Routing is now automatic, and we don't have to rely on manual checks or tribal knowledge."

Full visibility into every decision. Full audit trail across every action. Your data stays yours.

Every agent has clear checkpoints. You decide what gets reviewed, what auto-approves, and where the boundaries sit.

Approval thresholds, coding rules, escalation triggers — captured and enforced precisely.

For every action, you can open the reasoning and see where a value came from, which rule was applied, and why the decision was made.

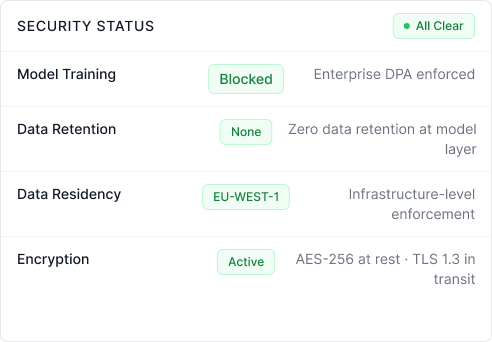

Encrypted in transit and at rest. Never used to train models. Zero data retention at the model layer. EU or US residency available. GDPR compliant with DPA.

Finance leaders trust Numra to transform their operations.

"Since we started using Numra, our team's communication and productivity have never been better. It's now a tool we can't imagine working without."

"A must have tool for modern finance teams. Autonomous accounting is here now, and Numra is leading the way."

"Numra is effective, easy to use and user-friendly. The team behind Numra have been fantastic to work with."

"Using Numra has made our team so much more efficient. We've seen a noticeable improvement in productivity since we started."

"Numra is incredibly user-friendly and helps us work so much faster. Highly recommended for any team looking to improve their finance processes."

"Numra is exactly what we needed. It's intuitive, fast, and fits seamlessly into our existing processes."

"Since we started using Numra, our team's communication and productivity have never been better. It's now a tool we can't imagine working without."

"A must have tool for modern finance teams. Autonomous accounting is here now, and Numra is leading the way."

"Numra is effective, easy to use and user-friendly. The team behind Numra have been fantastic to work with."

"Using Numra has made our team so much more efficient. We've seen a noticeable improvement in productivity since we started."

"Numra is incredibly user-friendly and helps us work so much faster. Highly recommended for any team looking to improve their finance processes."

"Numra is exactly what we needed. It's intuitive, fast, and fits seamlessly into our existing processes."

"It's like having a top-tier finance assistant who never drops the ball."

"This is exactly what finance teams need to free up time to focus on what matters."

"It's the first AI tool I've seen that genuinely simplifies finance processes without overpromising."

"It's like giving your finance team superpowers. Honestly game-changing."

"Numra was clearly built by people who've been in the trenches of the finance department — it tackles the real challenges teams face every day."

"Just incredible. Hands down the most impressive tool I've seen in the finance function. Hats off to the Numra team."

"It's like having a top-tier finance assistant who never drops the ball."

"This is exactly what finance teams need to free up time to focus on what matters."

"It's the first AI tool I've seen that genuinely simplifies finance processes without overpromising."

"It's like giving your finance team superpowers. Honestly game-changing."

"Numra was clearly built by people who've been in the trenches of the finance department — it tackles the real challenges teams face every day."

"Just incredible. Hands down the most impressive tool I've seen in the finance function. Hats off to the Numra team."

Book a 30-minute demo and we'll show you exactly how Numra can automate your finance workflows.

Book a Demo